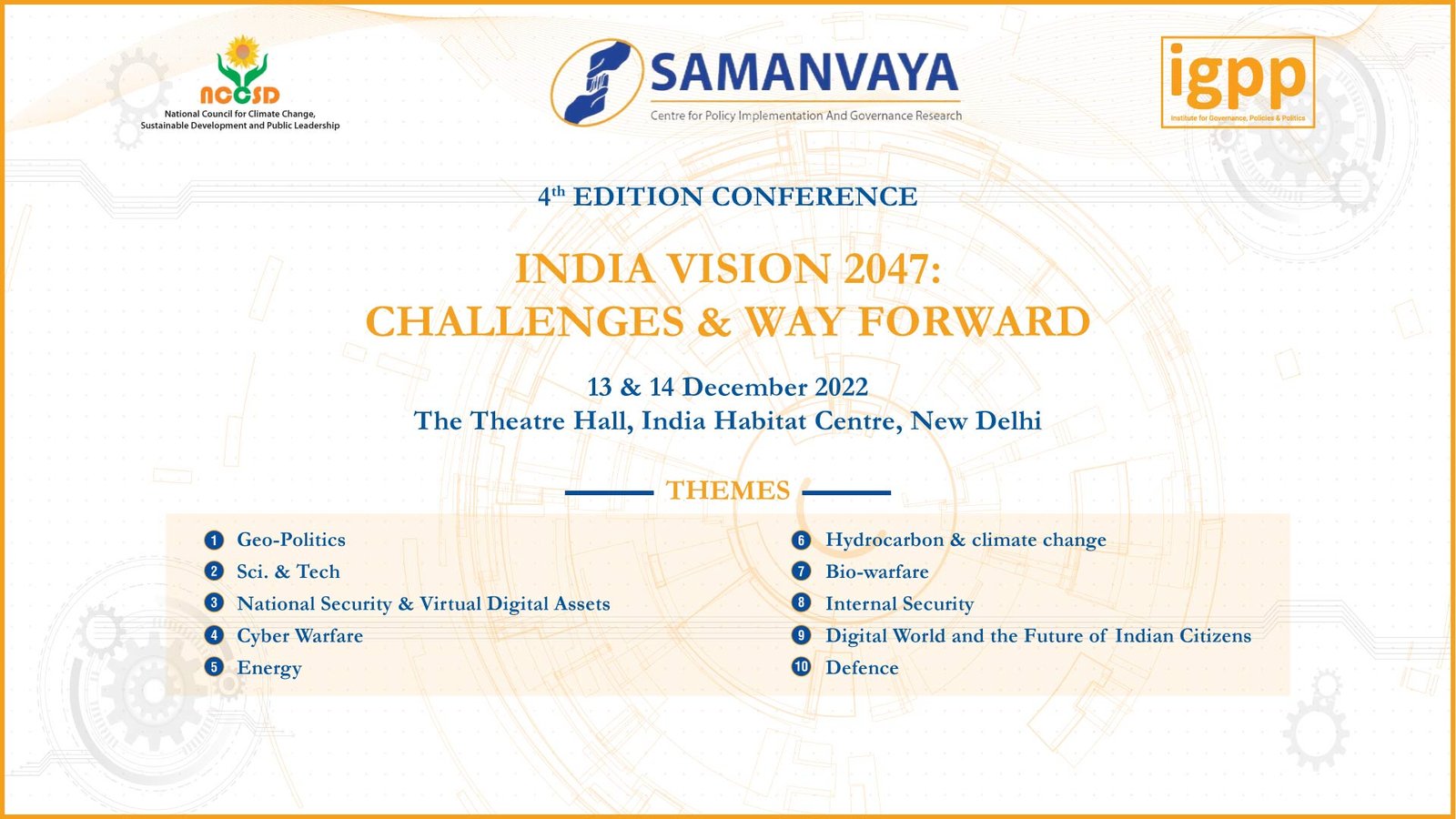

India Vision 2047: Challenges & Way Forward

National Security and Virtual Digital Asset

Speakers

1. Ms. Anna Roy (NITI Ayog)

2. Shri. Gopal Agarwal

BJP National Spokesperson on Economic Affairs

Representation of Bharat 3.0 (Industry Body)

3. Shri. Vivek Johari (CBIC Chairman)

4. Dr. Manish Tiwari

About the Session

The cross-border nature of virtual digital assets (VDAs) offers both promise and peril. On the one hand it can serve as a tool to raise capital, send remittances, and unlock the transformative potential of Web 3.0. On the other hand, there are national security concerns such as money laundering, terror financing, and several forms of cybercrime. It is integral, then, to devise a mechanism for transaction traceability and general surveillance of VDA networks. These realities were acknowledged recently in Oct 2022, by the Counter Terrorism Committee of the UN Security Council, in the Delhi Declaration on countering the use of new and emerging technologies for terrorist purposes.

Among other things the Delhi Declaration recognises the duality of opportunity and threat presented by VDAs, noting that they may offer economic opportunities but also present a risk of being misused, including for terror – financing. The Declaration notes that member states must consider and assess the risks presented by VDAs and implement risk-based anti-money laundering and counter-terrorist financing regulations, monitoring, and supervision on businesses dealing with VDAs. Mindful of this threat, India has several available measures to tackle it. For instance, it introduced a TDS component to track VDA transactions and sources of income for resident Indians and build guardrails to mitigate associated security risks. Similarly, it has a strong legal regime to prevent money laundering.